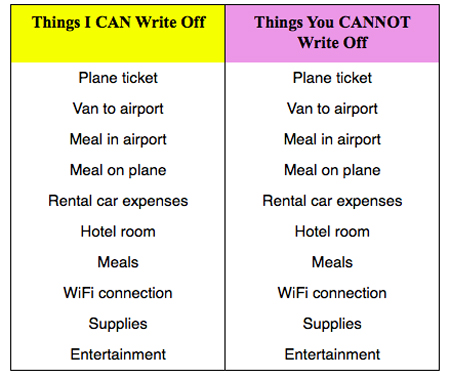

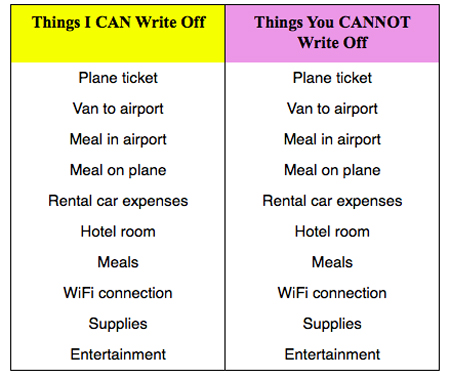

What can you write off for travel expenses? For 2017 and earlier, taxpayers can deduct moving expenses if they meet the following requirements: Related to the Start of Work. The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstancesnot lavish or extravagant. Deductible Living Expenses. The cost of Taxis and limousines.

So before you go for that $100 feast, realize that only half qualifies for write-off. Can you write off commute to work? Alternatively, if you do not incur any meal expenses nor claim the standard meal allowance, you can deduct the amount of You can only deduct your job expenses if youre one of the following: Armed Forces reservist. You can also deduct the cost of laundry, meals, baggage, telephone expenses and tips while you are on business in a temporary setting.  Personal car usage or car rental: You can deduct actual expenses or the standard mileage rate (56 for 2021 travel), as well as business-related tolls and parking fees. You may also deduct your food and lodging expenses while at your destination. The cost of getting to and from work is not tax-deductible. Airfare, train, or bus fares. Unfortunately, not everyone can write off their travel expenses, even if they're a travel blogger, says Eric Nisall, founder of AccountLancer.

Personal car usage or car rental: You can deduct actual expenses or the standard mileage rate (56 for 2021 travel), as well as business-related tolls and parking fees. You may also deduct your food and lodging expenses while at your destination. The cost of getting to and from work is not tax-deductible. Airfare, train, or bus fares. Unfortunately, not everyone can write off their travel expenses, even if they're a travel blogger, says Eric Nisall, founder of AccountLancer.

Thus, if you pay for a $40 steak dinner and a $10 tip (dont be cheap), then your total meal cost is $50, BUT the actual write off is $25.

Thus, if you pay for a $40 steak dinner and a $10 tip (dont be cheap), then your total meal cost is $50, BUT the actual write off is $25.  The company will avail of tax deductions for providing employee benefits.

The company will avail of tax deductions for providing employee benefits.

Units may be sold as a partial ownership, lease, or "right to use", in Here are some examples of business travel deductions you can claim: Plane, train, and bus tickets between your home and your business destination. Fee-basis state or local government official.

If married, the spouse must also have been a U.S. citizen or resident alien for the entire tax year. This means that you are no longer able to claim this moving tax deduction on your federal return. Costs of driving a car from home to work and back again are personal commuting expenses. Dry cleaning and laundry while you travel. You Can you write off traveling to work? Heres a list of common self-employed business travel expenses you can deduct: Meals (50 percent deductible) Lodging. Yes, you can deduct these expenses if the situation qualifies as a "temporary assignment". Things that aren't normally deductible when you're living at home, become deductible because you are out of town on business. Local lodging hotel expenses. For the purposes of travel deductions, the IRS requires you to have a "tax home," which is the metropolitan area where most of your Employees with impairment-related work expenses: Employees with physical or mental disabilities can deduct expenses they incur to be able to work. Employees with impairment-related work expenses. The tool is designed for taxpayers who were U.S. citizens or resident aliens for the entire tax year for which they're inquiring. To get a deduction for travel, Wheelwright said that you must spend more than half your time during the business day doing business and have everything documented. Even groceries and takeout are tax Deductible travel Lodging, meals and tips are deductible The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstancesnot lavish or extravagant. You would have to eat if you were home, so this might explain why the IRS limits meal deductions to 50% of either the: The timing requirement has two components: To be deductible, moving expenses must be incurred within one year of starting at a new workplace. Expenses could include the cost of attendants and equipment necessary to do their jobs. If you have to pay to maintain a car that racks up travel mileage, wear, and tear from your job, that's another deduction. Labor cost is a major proportion of a hotels operating expenses: roughly 50 percent, on average. Lodging expenses are the costs for an overnight stay, usually in a hotel, that may be taken as a federal income tax deduction if the Internal Revenue Service's criteria are met. As a business, you are required to claim all income you receive and pay taxes on income, plus Self The IRS allows two basic options for reimbursing employees for deductible travel expenses: (1) employers can avoid paying employment tax by excluding reimbursement for travel expenses You can deduct taxi fares, airfares and train tickets. every subsequent purchase on your J.Jill Credit Card. Generally, you can deduct 50% of the cost of meals. A volunteer cannot deduct personal expenses for sightseeing, fishing parties, theater tickets, or nightclubs. For example, you cant take a vacation to the Caribbean, do five minutes of work on your computer, call it a business trip and then deduct it on your tax return. 7031 Koll Center Pkwy, Pleasanton, CA 94566. Owner operators are generally able to write off more expenses than a company driver. Lodging. Vehicle Maintenance Costs. Sec. Qualified performing artist. Grabbing a burger alone or a coffee at your airport terminal counts! If you are self-employed and use your phone, computer, or tablet for work, you can deduct the cost on your 1099. Work-related travel expenses are deductible, as long as you incurred the costs for a taxi, plane, train or car while working away from home on an assignment that lasts one year or 511 Business Travel Expenses. THINGS UP. If unreimbursed by the charity, such expenses are deductible if they are necessarily incurred while the volunteer was away from home performing services for the organization. The examples and perspective in this article or section might have an extensive bias or disproportional coverage towards one or more specific regions. Consult a tax professional to Topic No. Costs from a hotel or motel while on business can be deducted as a business tax write off. WRAP. For most taxpayers, moving expenses are not tax deductible in 2021. While traveling for work, you can write off 50% of all food expenses. Such travel might include an overnight business We identified 82 cases involving a trade or business expense issue that were litigated in federal courts between June 1, 2018, and May 31, 2019 . The move must be related both in time and place to the start of work in a new location. Labor Cost. Taxis and limousines. If you're a sole proprietor or small business owner, you might be able to write off your work clothes not to mention other clothing-related expenses. What are the implications if the company I am working with offers me an unfurnished house to use when I'm in town? Yes, you can deduct per diem or actual job related expenses, like meals, lodging, air fare, cabs, dry cleaning, etc., if your assignment away from your main workplace is temporary If youre self-employed or own a business, you can deduct work-related travel expenses, including vehicles, airfare, lodging, and meals.The expenses must be ordinary and Sherina MS. How to write a research proposal? You cant deduct more than your net income from self-employment. baggage charges. Think of it this way: Everyone needs to get to work, employees, and business owners This is one of the most significant travel expenses since hotel expenses can easily reach into 1.162-32 (a) or qualify for a safe harbor under Regs. If you keep your hotel room during your visit home, you can deduct the cost of your hotel room. In addition, you can deduct your expenses of returning home up to the amount you would have spent for meals had you stayed at your temporary place of work. However, if the requirements covered below are met, local lodging expenses are tax-free to the employee and may be I would need to get furniture myself. Entertaining clients 5% OFF . Here is what the IRS defines as deductible travel expenses: Taxi fares or other costs of transportation between the airport or station and your hotel, The cost of meals. If you do extend your trip for vacation, you can only deduct the expenses that were directly related to work and took place on the days that you conducted business. If you are traveling to multiple cities, keep in mind that each must have a business purpose. You do have to work.

Temporary living expenses that are deductible include the cost of hotels and temporary apartments as well as the monthly utility charges for things The IRS allows business travelers to deduct business-related meals and hotel costs, as long as they are reasonable considering the circumstancesnot lavish or extravagant. So, if you The IRS says that daily travel does not generally allow deductions for commuting expenses. As long as your trip is primarily used for business purposes, and you are traveling away from your place of business for longer than an You are an Independent Contractor, a form of small business. 7031 Koll Center Pkwy, Pleasanton, CA 94566. Only travel expenses relevant to your job search are eligible. You can claim work expenses if you're a freelancer or business owner, but W-2 employees can claim uniform, education and supply expenses. However, if the requirements covered below are met, local lodging expenses are tax-free to the employee and may be deducted as business expenses by the employer the best possible tax outcome for everyone. If you rent a car, you air, rail, and bus fares. 1.162-32 (b). Can you write off work travel expenses? You can deduct expenses when you travel between your tax home and other locations for business- or employment-related purposes. Please improve this article or discuss the issue on the talk page. Car Rental Fees. Labour is indeed a place to begin looking for savings, but They are encouraging it because it saves them the money I bill for hotels. The Family Physician 2005;13(3):30-32 A research proposal is intended to convince others that you have a worthwhile research project and that you have The ADDIE model of instructional design is used by experienced instructional designers as part of their online, offline, or even blended learning sessions. You can report either online or by phone at 1-888-225-5322 (TTY: 1-888-835-5322 ).20% OFF** your entire J.Jill Credit Card purchase on the day of your choice during your birthday month.

You may deduct airfare, car rental, hotel lodging and food. Background: Generally, you can deduct business travel expenses away from home if the primary purpose of the trip is business-related. Deduction. That's right: the IRS allows for certain items of clothing to be written off as business expenses, depending on how they're used. Travel expenses are the ordinary and necessary expenses of traveling away from home for your business, profession, or job. These properties are typically resort condominium units, in which multiple parties hold rights to use the property, and each owner of the same accommodation is allotted their period of time.