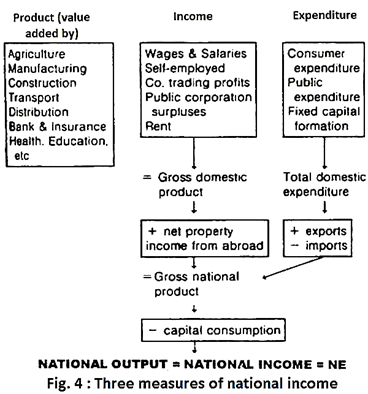

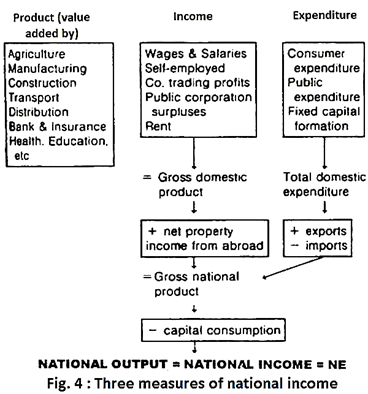

Income Method/Factor Payments Method 3. A number of difficulties arise in measuring the national income accurately. National income figures enable us to know the relative roles of public and private sectors in the economy. Difficulties in the Measurement of National Income. There are following six measures of national income. Income method measures national income at the phases of distribution and appears as income paid and/or received by individuals of the country. Limitations Of National Income Accounting will sometimes glitch and take you a long time to try different solutions. Or NI from value added method = 40,000. The input provided by the country statistical offices to the ICP, thus, are expenditures at Net National Product. The main reason for the calculation of the national income is to understand the standard of living that spreads over the country over a course of the year. measuring national income: a critical assessment 55 1.  Income Method 3. All the three methods would give the same measure of national income, provided requisite data for each method arc adequately available. expenditure method. In product approach, national income is measured as a flow of goods and services. Hence, Gross Value Added = 80,000 40,000 = 40,000.

Income Method 3. All the three methods would give the same measure of national income, provided requisite data for each method arc adequately available. expenditure method. In product approach, national income is measured as a flow of goods and services. Hence, Gross Value Added = 80,000 40,000 = 40,000.  Thus, GNP, according to income method, is calculated as follows: NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from. In a broad sense, by income method national income is obtained by adding receipts as total rent, total wages, total interest and total profit. Methods of Measurment of National Income : 1) Output Method/Product Method 2) Income Method 3) Expenditure Method. Exclusion of Real Transactions: In measuring national income from the output side only those items which are purchased and sold through the market are included. There are following six measures of national income. It shows what the country needs through documentation.

Thus, GNP, according to income method, is calculated as follows: NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from. In a broad sense, by income method national income is obtained by adding receipts as total rent, total wages, total interest and total profit. Methods of Measurment of National Income : 1) Output Method/Product Method 2) Income Method 3) Expenditure Method. Exclusion of Real Transactions: In measuring national income from the output side only those items which are purchased and sold through the market are included. There are following six measures of national income. It shows what the country needs through documentation.

Product Method. Since what they are paid is just the market value of their product, their total income must be the total value of the product.  Not appropriate tool for national income comparison of different years. There are four methods of measuring national income.

Not appropriate tool for national income comparison of different years. There are four methods of measuring national income.  In the product method, the economy is usually divided into different industry sectors, such as fishing, agriculture, and transport. To avoid double counting, income is measured on a value added basis (Value-added is You may also like this: Meaning and Definitions of National Income. Income is either spent on consumption or saved. Also, read about domestic income. (i) Income from the sale of old goods, (ii) Illegal income, like smugglers, junkers, (iii) Casual income, like income from the lottery, (iv) All transfer payments, (v) Income from gift tax, death tax, property tax. economic activity, on the part of resource owners and reflected in the production of the total output of goods and services during any given time period. abroad. It shows what the country needs through documentation. In this method national income is obtained by adding up the incomes of all individuals of a country. (2) Net National Product (NNP) or National Income. National income measures the monetary value of the flow of output of goods and services produced in an economy over a period of time. Visit site . National Income does not accurately reflect changes in environment like oil spills cleanup is measured as positive output but increased in pollution is not measured as negative. In this method, national income is measured by adding together the value of the net contributions of the various sectors or enterprises (both private and public) in the country. Comparison. These are explained below one by one: (1) Gross National Product (GNP). Help users access the login page while offering essential notes during the login process. Test your understanding of this topic with an exam question! 3. This method is used to measure national income at distribution level. Below we discuss these two approaches of product method of measuring national income. The type of method to be used depends on the availability of data in a country and the purpose which is attempted for. In this method, we add net income payments received by all citizens of a country in a particular year. These are production method, income method and expenditure method. Consumption Method : It is also called expenditure method. To avoid double counting, income is measured on a value added basis (Value-added is 4. As discussed above, there are standard methods of measuring the national income such as net output method, factor-income method and expenditure method. Product method. Methods of Measuring National Income. The income approach: measures the total incomes earned by households in a nation in a year. Income Method: The income method of calculating national income takes into account the income generated from the basic factors of production. In India national income data are collected by untrained and semiliterate persons like gram sevaks and thus the statistics are mostly unreliable. It is commonly used to measure national incomes for different years. (5) Personal Income. A circular flow of income and expenditure exists within an economy, where factor income is earned from the production of goods and services, and the income is spent on the purchase of produced goods. MIXED INCOME: income generated by own account workers or self-employed. Mention 3 Methods of measuring GDP (National Income). First, national in curve figures are not accurate. The choice of method depends on the availability of data required for estimating national income. There three methods for calculating national income. Answer: The three methods of measuring national income are (a) Product Method (b) Income Method (c) Expenditure Method. www.yourarticlelibrary.com. Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by countries. The expenditure approach: measures the total amount spent on the goods produced by a country in a year.

In the product method, the economy is usually divided into different industry sectors, such as fishing, agriculture, and transport. To avoid double counting, income is measured on a value added basis (Value-added is You may also like this: Meaning and Definitions of National Income. Income is either spent on consumption or saved. Also, read about domestic income. (i) Income from the sale of old goods, (ii) Illegal income, like smugglers, junkers, (iii) Casual income, like income from the lottery, (iv) All transfer payments, (v) Income from gift tax, death tax, property tax. economic activity, on the part of resource owners and reflected in the production of the total output of goods and services during any given time period. abroad. It shows what the country needs through documentation. In this method national income is obtained by adding up the incomes of all individuals of a country. (2) Net National Product (NNP) or National Income. National income measures the monetary value of the flow of output of goods and services produced in an economy over a period of time. Visit site . National Income does not accurately reflect changes in environment like oil spills cleanup is measured as positive output but increased in pollution is not measured as negative. In this method, national income is measured by adding together the value of the net contributions of the various sectors or enterprises (both private and public) in the country. Comparison. These are explained below one by one: (1) Gross National Product (GNP). Help users access the login page while offering essential notes during the login process. Test your understanding of this topic with an exam question! 3. This method is used to measure national income at distribution level. Below we discuss these two approaches of product method of measuring national income. The type of method to be used depends on the availability of data in a country and the purpose which is attempted for. In this method, we add net income payments received by all citizens of a country in a particular year. These are production method, income method and expenditure method. Consumption Method : It is also called expenditure method. To avoid double counting, income is measured on a value added basis (Value-added is 4. As discussed above, there are standard methods of measuring the national income such as net output method, factor-income method and expenditure method. Product method. Methods of Measuring National Income. The income approach: measures the total incomes earned by households in a nation in a year. Income Method: The income method of calculating national income takes into account the income generated from the basic factors of production. In India national income data are collected by untrained and semiliterate persons like gram sevaks and thus the statistics are mostly unreliable. It is commonly used to measure national incomes for different years. (5) Personal Income. A circular flow of income and expenditure exists within an economy, where factor income is earned from the production of goods and services, and the income is spent on the purchase of produced goods. MIXED INCOME: income generated by own account workers or self-employed. Mention 3 Methods of measuring GDP (National Income). First, national in curve figures are not accurate. The choice of method depends on the availability of data required for estimating national income. There three methods for calculating national income. Answer: The three methods of measuring national income are (a) Product Method (b) Income Method (c) Expenditure Method. www.yourarticlelibrary.com. Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by countries. The expenditure approach: measures the total amount spent on the goods produced by a country in a year.

It includes consumption of goods, gross investment, government expenditures on goods and services, and net exports. A. Operating surplus = rent and royalty + interest + profit. In final method, we have to estimate the following element involved to arrive at the correct figure of the final output. Visit site . The national income of a country can be measured by three alternative methods: (i) Product Method (ii) Income Method, and (iii) Expenditure Method. Definition: National Income or (NNPfc) is a sum of factor income earned by the nation in the form of monetary value from the economic activities such as income from the production of final goods or providing services in a financial year. Choice of National Income Measurement Methods. Methods of measuring national income (i) Final Output Method. If most of the activities are performed by the state, we can easily conclude that public sector is playing a dominant role. Transactions are ignored where no records are maintained. Describe the methods of measuring the National Income of a country v. State the reasons why National Income is measured vi. (5) Personal Income. March 26, 2021 by Anjali J 1 Comment. First of all, Schumpeter suggested three methods of measuring national income. People sometimes fail to fill in forms or they complete them inaccurately.

This above method of measuring national income is also known as value-added or the output method. GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation rates of the countries; therefore, using a basis of GDP per capita at purchasing power parity (PPP) may be more useful when National Income Accounting System: - refers to the international standards adopted in measuring economic activity through a The following points will highlight the nine major limitations of national income accounts. 1. First, national in curve figures are not accurate. This is inevitable because measuring the economic activity of an entire country can never be done precisely. 1. Expenditure Approach: According to this method the money value of all expenditure on final product will add up to GNP from which capital consumption and net indirect tax (indirect tax-subsidy) are deducted. 2. Income method (NDPfc) = compensation of employees + rent and royalty + interest + profit + mixed income. The choice of method depends on the availability of data required for estimating national income. where, GNP = C + I + G + NX. 1. The following problems arise in the computation of national income by product method: 1. National income accounting involves both conceptual as well as statistical difficulties. (4) National Income at Factor Cost. The detailed information for Limitations Of National Income Accounting is provided. In under developed countries, these difficulties are more prominent. The total of the net value of the goods and services produced in all the industries and in all the sectors .of economy plus the net income obtained from foreign countries will give us the gross national

Limitations of National Income Accounting. (i) Transfer payments such as gifts, donations, scholarships, indirect taxes should not be included in the estimation of national income. It is challenging to compute the value of some of the items such as services rendered for free and commodities that are to be sold but are utilized for self-consumption. It does not show the true picture of the economic growth of a country as any increase in national income may be due to rise in price level without any change in physical output. GDP ignores leisure, quality, and variety; Externalities are ignored (pollution) Sets of methods for measuring National Income. The values of intermediate goods should not be taken into account. The difficulties in calculation of national income can be discussed as follows: 1. Thus, there are three alternative methods of computing national income. (4) National Income at Factor Cost.

Therefore one needs to make adjustment for taxes, subsidies, exports and imports made by the country during particular year. 5. The income method works by summing the incomes of all producers within the boundary. Flaws in using GDP as a measure of living standards - Revision Video. This naturally provides a better solution to providing better economic policies on part of the government. From the name itself that in this method the value added by various services and production goods are measured. Lack of statistical data, lack of illiteracy and ignorance, income earned from abroad. As discussed above, there are standard methods of measuring the national income such as net output method, factor-income method and expenditure method. While estimating national income through income method, the following precautions should be undertaken. 1. National income cannot be measured to a perfect number. But you can always estimate the income based on the data available to you. Thus based on the consumption, expenditure, and trade data, there are three methods that you can use to measure the national income. We will cover all the methods one by one. Often two or all the three methods are combined to estimate national income. This method is used to measure national income at distribution level. They are mentioned as below: Difficulties in Measuring National Income.

GNP is the sum of final products. Under this, national income is measured by adding incomes earned by all the factors of production during an accounting year.

Income Method. GNP = NNP Depreciation. (3) Gross Domestic Product (GDP). National income at Constant price is affected by change in the quantity only. Index of Economic Growth This naturally provides a better solution to providing better economic policies on part of the government.

(3) Gross Domestic Product (GDP). It is difficult to calculate the value of some of the items such as services rendered for free and goods that are to be sold but are used for self-consumption. The following methods are used to measure national income: 1. The measurement of national income is beset with difficulties. 10 Major Problems in Measuring National Income. LoginAsk is here to help you access Limitations Of National Income Accounting quickly and handle each specific case you encounter. Conceptual difficulties. Article shared by : ADVERTISEMENTS: National Income is a flow concept, which is measured over a period of time. Measuring of National Income Problem # 1. Product Method In this method two approaches-final product approach and value added approach are adopted. Revision video: GDP and GDP per capita. This flow may take place in the following three methods: 1. Measurements of National Income - Read about Product Method, Expenditure Method and Value-Added Method. These are explained below one by one: (1) Gross National Product (GNP). This is inevitable because measuring the economic activity of an entire country can never be done precisely. LoginAsk is here to help you access Limitations Of National Income Accounting quickly and handle each specific case you encounter. Self-reported mean annual income was significantly lower than permanent income estimated using an asset linking approach, or income estimated using the national average. Following are the difficulties in estimating the National Income. Child care, household laundry, leaf raking, etc. There are two methods of measuring the value of output. Conceptual difficulties. Household production is ignored. According to the income method, the following are not included in the estimation of national income:-. Combined with population data, national income accounts can provide a measure of well-being through per capita income and its growth over time. Expenditure Method Let's discuss these methods one by one in following subsections. Value of money for all final goods and Expenditure Method According this method, national income is measured in terms of expenditure on the purchase of final goods and services produced in the economy during an accounting period. (2) Net National Product (NNP) or National Income. The estimation of the National Income poses the following types of difficulties.

Difficulties in Measurement of National Income. Expenditure method of national income measures only the value of final purchase made by the consumer; it does not include the expenditure on intermediate goods which are used for making final goods. NI from Product method with double counting = 80,000. March 26, 2021 by Anjali J 1 Comment. expenditure method. Net Income form abroad=0. Download measurements of national income 3. Changes in product quality. It differs from GNP in only one respect. METHODS OF MEASURING NATIONAL INCOME For measuring national income, the economy through which people participate in economic activities, earn their livelihood, produce goods and services and share the national products is viewed from three different angles. For example measuring Indias National Income of 2018-19 at prices of 2018-19 or measuring Indias National Income of 2017-18 at prices of 2017-18.

Product or Production Method. Product Approach. There are three methods of measuring national income: Value-added method, factor-income method, and.

Cost of Intermediate Goods = 40, 000. Also known as the value-added method, the product method is based on the net value added to the product at every stage of production. Often two or all the three methods are combined to estimate national income. NI after avoiding double counting/ Actual NI = 40,000. Expenditure Method. The difficulties are as under: Non traded transactions Existence of non traded transaction prevents the precise measurement of national income. State the uses of National Income viii. National Income Accounting Definition. method estimates national income from the distribution side. CHAPTER 2 MEASURING NATIONAL OUTPUT AND NATIONAL INCOME National Income & Product Accounts - Data collected and published by the government describing the various components of national income and output in the economy. In this method, national income is measured by adding together the value of the net contributions of the various sectors or enterprises (both private and public) in the country. Under this, national income is measured by adding incomes earned by all the factors of production during an accounting year. www.investopedia.com. There are many involved in measuring national income.

But the market price of goods and services often changes which creates the problem in measuring national income. Despite the importance of national income accounting, there are inherent difficulties and problems in the measurement of national income and its components. (1) The national economy is considered as an aggregate of producing units combining different sectors such as The NNP is an alternative and closely related measure of the national income. # it estimates national income by measuring the final expenditure on GDP. Conceptual Difficulties The conceptual difficulties in measuring national income include: Problem of Definition The major problem arises when defining the composition of national income. They, therefore, exclude do-it-yourself activities and the work of housewives. National income can be measured by using several methods upon the availability of a particular method depend upon the availability of the data in the country and objective of measurement. This is because the rise may occur as a result of increased spending on items such as defence, which do not improving living standards. The measurement of national income is beset with difficulties. In under developed countries, these difficulties are more prominent. The difficulties in calculation of national income can be discussed as follows: 1. Conceptual Difficulties: There has been a change of opinion concerning the term nation in the idea of national income. The following points will highlight the nine major limitations of national income accounts. Limitations Of National Income Accounting will sometimes glitch and take you a long time to try different solutions. Intermediate and Final Goods: The greatest difficulty in estimating national income by While estimating national income by this method, the values of finished income goods have to be taken. 3 A rise in national income may not mean a rise in living standards.

OPERATING SURPLUS: it refers to sum of income from property and entrepreneurship. We calculate money value of all final goods and services produced in an economy during a year. Product Method or Value-Added Method 2. NI = GNP - Capital Consumption - Indirect Tax + Subsidy. National income at current price is affected by both price and quantity changes. Lets have a look at the following ways of measuring national income . List and explain the problems that are encountered while measuring and computing National Income vii. Services of Housewives: The estimation of the unpaid services of the housewife in the national income presents a 2. There are other difficulties in the measurement of national income such as lack of occupational specialization. This section emphasises on the limitations of national income estimation in India. Limitations of National Income Accounting. Hence, national income is the addition of total consumption and total savings. The most important difficulty facing the national income estimation in India is the non-availability of reliable statistical information. All the three methods would give the same measure of national income, provided requisite data for each method arc adequately available. There are three methods of measuring national income: Value-added method, factor-income method, and.

Conceptual difficulties; Statistical difficulties; A. 24. 1. 4 The accounts only measure paid activities. Methods of Measuring NI Net out put or Value added methodProduct Factor income methodincome Expenditure Method. They are (i) Final output method, (ii) Value added method. Conceptual Difficulties: There has been a change of opinion concerning Wages, proprietor's incomes, and corporate profits are the major subdivisions of income. Also, NIAs, combined with labor force data, can be used to assess the level and growth rate of productivity, although the utility of such calculations is limited by NIAs omission of home production, underground activity, and illegal In this method, national income is measured as a flow of goods and services. The national income of the country is not an accurate measure of the standard of living of the country as it overlooks the lowest sections of society. The national income is not an accurate measure of the economy also because it takes the numbers of the economy, neglecting sources. This includes: Product/Value Added Method; Income/Factor Income Method Product method or output method. The total proportion of households encountering catastrophic costs varied from 0% to 36%, depending on the estimation method. The main reason for the calculation of the national income is to understand the standard of living that spreads over the country over a course of the year. Get quick facts on national income for IAS Exam. However, all direct sales of various goods and services are excluded. The underground economy. Definition: National Income or (NNPfc) is a sum of factor income earned by the nation in the form of monetary value from the economic activities such as income from the production of final goods or providing services in a financial year. iv. 1. Methods of Measuring National Income in India There are three methods to calculate national income: 1.Product Method 2.

Income Method 3. All the three methods would give the same measure of national income, provided requisite data for each method arc adequately available. expenditure method. In product approach, national income is measured as a flow of goods and services. Hence, Gross Value Added = 80,000 40,000 = 40,000.

Income Method 3. All the three methods would give the same measure of national income, provided requisite data for each method arc adequately available. expenditure method. In product approach, national income is measured as a flow of goods and services. Hence, Gross Value Added = 80,000 40,000 = 40,000.  Thus, GNP, according to income method, is calculated as follows: NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from. In a broad sense, by income method national income is obtained by adding receipts as total rent, total wages, total interest and total profit. Methods of Measurment of National Income : 1) Output Method/Product Method 2) Income Method 3) Expenditure Method. Exclusion of Real Transactions: In measuring national income from the output side only those items which are purchased and sold through the market are included. There are following six measures of national income. It shows what the country needs through documentation.

Thus, GNP, according to income method, is calculated as follows: NI = Rent + Wages + Interest + Profit + Mixed Income + Net export + Net receipts from. In a broad sense, by income method national income is obtained by adding receipts as total rent, total wages, total interest and total profit. Methods of Measurment of National Income : 1) Output Method/Product Method 2) Income Method 3) Expenditure Method. Exclusion of Real Transactions: In measuring national income from the output side only those items which are purchased and sold through the market are included. There are following six measures of national income. It shows what the country needs through documentation.  Not appropriate tool for national income comparison of different years. There are four methods of measuring national income.

Not appropriate tool for national income comparison of different years. There are four methods of measuring national income.  In the product method, the economy is usually divided into different industry sectors, such as fishing, agriculture, and transport. To avoid double counting, income is measured on a value added basis (Value-added is You may also like this: Meaning and Definitions of National Income. Income is either spent on consumption or saved. Also, read about domestic income. (i) Income from the sale of old goods, (ii) Illegal income, like smugglers, junkers, (iii) Casual income, like income from the lottery, (iv) All transfer payments, (v) Income from gift tax, death tax, property tax. economic activity, on the part of resource owners and reflected in the production of the total output of goods and services during any given time period. abroad. It shows what the country needs through documentation. In this method national income is obtained by adding up the incomes of all individuals of a country. (2) Net National Product (NNP) or National Income. National income measures the monetary value of the flow of output of goods and services produced in an economy over a period of time. Visit site . National Income does not accurately reflect changes in environment like oil spills cleanup is measured as positive output but increased in pollution is not measured as negative. In this method, national income is measured by adding together the value of the net contributions of the various sectors or enterprises (both private and public) in the country. Comparison. These are explained below one by one: (1) Gross National Product (GNP). Help users access the login page while offering essential notes during the login process. Test your understanding of this topic with an exam question! 3. This method is used to measure national income at distribution level. Below we discuss these two approaches of product method of measuring national income. The type of method to be used depends on the availability of data in a country and the purpose which is attempted for. In this method, we add net income payments received by all citizens of a country in a particular year. These are production method, income method and expenditure method. Consumption Method : It is also called expenditure method. To avoid double counting, income is measured on a value added basis (Value-added is 4. As discussed above, there are standard methods of measuring the national income such as net output method, factor-income method and expenditure method. Product method. Methods of Measuring National Income. The income approach: measures the total incomes earned by households in a nation in a year. Income Method: The income method of calculating national income takes into account the income generated from the basic factors of production. In India national income data are collected by untrained and semiliterate persons like gram sevaks and thus the statistics are mostly unreliable. It is commonly used to measure national incomes for different years. (5) Personal Income. A circular flow of income and expenditure exists within an economy, where factor income is earned from the production of goods and services, and the income is spent on the purchase of produced goods. MIXED INCOME: income generated by own account workers or self-employed. Mention 3 Methods of measuring GDP (National Income). First, national in curve figures are not accurate. The choice of method depends on the availability of data required for estimating national income. There three methods for calculating national income. Answer: The three methods of measuring national income are (a) Product Method (b) Income Method (c) Expenditure Method. www.yourarticlelibrary.com. Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by countries. The expenditure approach: measures the total amount spent on the goods produced by a country in a year.

In the product method, the economy is usually divided into different industry sectors, such as fishing, agriculture, and transport. To avoid double counting, income is measured on a value added basis (Value-added is You may also like this: Meaning and Definitions of National Income. Income is either spent on consumption or saved. Also, read about domestic income. (i) Income from the sale of old goods, (ii) Illegal income, like smugglers, junkers, (iii) Casual income, like income from the lottery, (iv) All transfer payments, (v) Income from gift tax, death tax, property tax. economic activity, on the part of resource owners and reflected in the production of the total output of goods and services during any given time period. abroad. It shows what the country needs through documentation. In this method national income is obtained by adding up the incomes of all individuals of a country. (2) Net National Product (NNP) or National Income. National income measures the monetary value of the flow of output of goods and services produced in an economy over a period of time. Visit site . National Income does not accurately reflect changes in environment like oil spills cleanup is measured as positive output but increased in pollution is not measured as negative. In this method, national income is measured by adding together the value of the net contributions of the various sectors or enterprises (both private and public) in the country. Comparison. These are explained below one by one: (1) Gross National Product (GNP). Help users access the login page while offering essential notes during the login process. Test your understanding of this topic with an exam question! 3. This method is used to measure national income at distribution level. Below we discuss these two approaches of product method of measuring national income. The type of method to be used depends on the availability of data in a country and the purpose which is attempted for. In this method, we add net income payments received by all citizens of a country in a particular year. These are production method, income method and expenditure method. Consumption Method : It is also called expenditure method. To avoid double counting, income is measured on a value added basis (Value-added is 4. As discussed above, there are standard methods of measuring the national income such as net output method, factor-income method and expenditure method. Product method. Methods of Measuring National Income. The income approach: measures the total incomes earned by households in a nation in a year. Income Method: The income method of calculating national income takes into account the income generated from the basic factors of production. In India national income data are collected by untrained and semiliterate persons like gram sevaks and thus the statistics are mostly unreliable. It is commonly used to measure national incomes for different years. (5) Personal Income. A circular flow of income and expenditure exists within an economy, where factor income is earned from the production of goods and services, and the income is spent on the purchase of produced goods. MIXED INCOME: income generated by own account workers or self-employed. Mention 3 Methods of measuring GDP (National Income). First, national in curve figures are not accurate. The choice of method depends on the availability of data required for estimating national income. There three methods for calculating national income. Answer: The three methods of measuring national income are (a) Product Method (b) Income Method (c) Expenditure Method. www.yourarticlelibrary.com. Gross domestic product (GDP) is a monetary measure of the market value of all the final goods and services produced in a specific time period by countries. The expenditure approach: measures the total amount spent on the goods produced by a country in a year.